Meet the author:

Carlos A. Bazan

Carlos has ample experience operating peer to peer and traditional, independent car rental companies, including neighborhood locations and airport facilities. Carlos has owned car rental operations in the San Diego, Los Angeles, Phoenix, Las Vegas, Reno/Tahoe, San Jose, Dallas, Houston, and Honolulu markets and is in charge now of over 100 franchised locations in 14 countries.

A rigid fleet is a liability disguised as discipline. A nimble fleet is one that moves with the market, not behind it. Being nimble means recognizing that demand isn’t static. It flexes by day, by week, by event, by season. Cars that stay idle burn capital. Cars that meet the market where it actually is protect margin.

In car rental, nimble means you plan core fleet around high-confidence demand and keep a flexible layer to absorb spikes. It means you monitor when underperformers drag utilization and cut or reassign them before they drag your books. It means you see a ski market, a beach town, and a suburban commuter lot as three distinct use cases, not three locations to copy-paste the same inventory.

Operators obsessed with big car counts often miss that 1,000 cars with poor allocation is worse than 500 well deployed. Bigger does not mean safer. Return on asset, cost per unit, and daily rate matter more. Nimble means you run those numbers monthly and pivot. It means your fleet plan is alive, not a spreadsheet frozen on January 1st. It means you’re ready to source short-term units if your forecast misses. It means you don’t hoard vehicles that no longer pay their way.

A nimble operator accepts that perfect prediction is fiction. But active adjustment is fact. Rigid fleet owners get stuck with surplus they can’t sell, or shortages they can’t fill. Nimble ones take advantage of unexpected shifts. They profit off the same volatility that bankrupts the inflexible. In this business, the market punishes the static and pays the adaptive. That’s what nimble means.

Empty lots look beautiful! Photo: Courtesy, CA Bazan, LLP. CC BY-NC-SA.

How to Understand Market Dynamics Per Vehicle Class Per Month

I’ll mention the word, “liability” again. I don’t like it, so I want you to understand how to avoid it. Guesswork is a liability. Building a system that measures each vehicle class against demand shifts is not optional; it’s the baseline. Use core metrics: utilization, length of rental, net rate per day, miles driven, and profit per unit. Break it down by location, by month. Compare each cycle to historical trends but don’t assume history repeats exactly.

Build an annual calendar of local events, peak seasons, and demand spikes. Cross-reference these with your data to spot gaps or overlap. Booking curves help you see when to push more cars into a market or pull them out before they cost you. Demand drops left unchecked compound losses.

Actionable: produce a rolling 12-month scorecard for every class. Color-code underperformers. Track which models and classes under-deliver consistently. Reallocate them, shift them, or sell them while their resale holds. Layer in what-if scenarios. Ask what happens if you hold too long or sell too soon. Run the math on alternative uses of capital.

Test price elasticity within each segment. A slight increase or decrease on certain classes can smooth utilization dips. Small pricing moves add up if done consistently. Build flexibility into your booking strategy. Sometimes you should overbook certain categories and plan free upgrades for your renters – but never leave them stranded. Knowing where you can do this profitably comes from data at this granularity.

Treat each vehicle class like its own business. One might drive bookings. Another might exist to absorb overflow. Others might just tie up cash. Adjust accordingly. Hold weekly pulse checks. Do a monthly deep dive. Make changes immediately when the data justifies it. This is not a theory exercise.

When you understand every class, every month, you stop letting your fleet control you. You control the fleet. You decide which vehicles stay, which move, which go. That is how you protect profit and prevent waste. Nimble is not chaos; it’s discipline executed daily.

The Key Numbers: Utilization, Length of Rental, and the Myth of Fleet Size

Your fleet size and location count are distractions when used as vanity metrics. They are a distraction even if you pretend to use them as a basis for your proformas and your P&L. The reality is that profit depends on how each unit performs, not how many sit on your books. Operators often brag about fleet size but cannot show healthy ROA per car. Bigger only works if each unit earns more than it costs to hold.

Utilization is the hard truth. Track it daily, review it weekly, understand it monthly. High utilization with low net rate is just as flawed as low utilization with high daily rates. Both waste capacity. Aim for balance. Length of rental matters too. A three-day average at a strong daily rate can outperform a seven-day stretch at discount prices. On the other hand, larger lengths of rental account for less vehicle turn arounds and lower operational costs. Work these numbers by segment, by market, and plug in the numbers on a spreadsheet. Once you see your trends and numbers, you’ll understand how to price accordingly to be on the top of your bell curve daily rate V. LOR for maximum profitability.

Run scenario models. What happens if you shrink fleet by 10% but push utilization up by 15%? Or if you shift 5% of idle cars to a stronger location? Gross revenue grows when you put assets where they actually earn. Your cash flow tells you whether your fleet is working. Not a static P&L that hides underperformance.

Map your locations to actual demand. A single site with strong LOR and repeat customers beats three underperforming storefronts bleeding margin. Watch how booking pace shifts by day of week, holiday, or event. The goal is never to have cars for the sake of having cars. It is cars deployed where they produce consistent net profit.

Myth: more cars means more power. Truth: more cars poorly managed is more risk. Know the numbers. Make them visible. Build a dashboard. Train your team to watch it. Anyone ignoring real utilization, real yield per unit, and real cost to hold is not running a fleet. They’re just stockpiling liabilities.

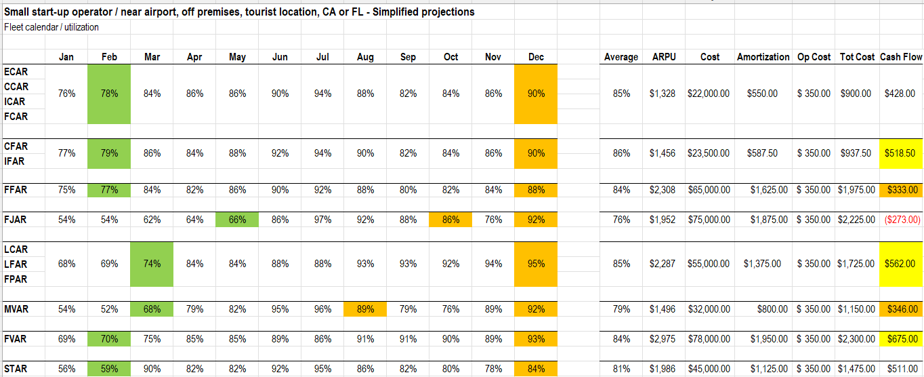

Simulation of numbers for fleet planning and strategy. Photo: Courtesy, CA Bazan, LLP. CC BY-NC-ND.

How to Plan Fleet Growth Ethically: Preemptive Overbooking and Real Adjustments

OK, so we have discussed fleet size, and we understand that fleet growth is not hoarding cars on a wish and a prayer. It is a rational, measured, and data-driven daily exercise. You start by mapping real booking pace by class and you know your core peak periods. With this you know where you can sell more capacity than you physically own – but ethically, strategically, and by car class, not by fleet size.

Preemptive overbooking is not reckless. It is a calculated hedge. Economy and compact classes should run tight. Free upgrades plug the gap when you oversell the base class. This keeps high-yield units moving and protects your customer promise.

Act on your numbers. When you see consistent spikes above your physical fleet, expand capacity smartly. New fleet acquisition, seasonal swaps, even shorter-term vehicle purchases can bridge gaps. Be honest about what you can’t cover. Never accept bookings you know you can’t serve.

Use this approach to plan real growth. Don’t buy cars because you feel bigger is better. Buy because your data says you’re leaving revenue on the table if you don’t. Fleet decisions are capital allocation. Treat them like investments, not trophies.

Ethical planning means no stranded renters. It means free upgrades when you oversell. It means building trust because you always deliver a vehicle, even if it costs you an upgrade.

Stay flexible. Keep supply options open. Monitor resale markets to exit aging units profitably. Build vendor relationships so you can add cars mid-season if needed. And likewise, build a remarketing network so you can offload inventory when needed.

The operator who plans growth this way outperforms the operator chasing volume for vanity. Real growth means cars that pay their way, protect your brand, and keep customers loyal.

Why It’s Paramount to Never Strand a Renter and How Free Upgrades Work

Leaving a customer without a car is an operational failure. No amount of fleet size or marketing spend repairs the damage. A stranded renter tells ten more. A smart fleet plan ensures you always have a buffer.

This is why overbooking, when done right, works. You run base classes tight because you know some percentage of renters will no-show, extend, or swap. When you oversell intentionally, you build in a small surplus of higher-class vehicles to handle the overflow.

Artwork created using ChatGPT.

Free upgrades are not lost money. They are brand equity. An economy renter upgraded to a midsize or SUV feels valued. They come back. The slight margin loss is recouped in repeat bookings and positive reviews.

Build your daily allocation to end each day with a handful of cars still on the lot. Never squeeze so tight that your last vehicle is gone by 5 PM. Hold back enough to absorb flight delays, unexpected walk-ins, or mechanical issues.

Teach your staff how to handle overbookings. They need authority to upgrade and reassure. The goal is zero stranded renters and maximum utilization.

A fleet plan without this cushion is gambling with reputation. The operator who blends intentional overbooking with disciplined upgrades and daily margin protects both profit and trust.

You do not need to be the cheapest. You need to be the one who never leaves a family stuck at the counter. That is how you build real loyalty, car by car.

Until next time, here’s to smarter, safer, and more efficient car rentals!

Warm regards, and ramp up that utilization!

Carlos Bazan / Editor